An accountant resume is a document that showcases an accountant’s work experience, education, and certification. The templates accommodate accountants from all backgrounds and experience levels. For instance, an entry-level accountant or a financial executive can complete the following documents to apply for a job position.

Before writing the resume, the applicant should consider its primary purpose: to offer a skill set that the hiring company needs or wants. The candidate achieves this goal by using an organized template that highlights their best and most qualifying skills. The resume must include accurate details about the applicant’s experiences. Interviewers immediately reject prospective employees who lie or enter false information on their applications.

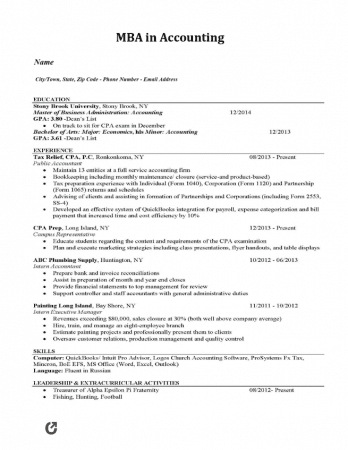

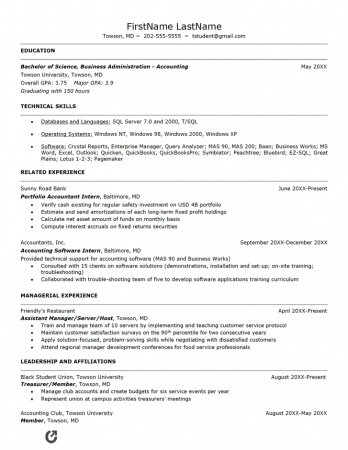

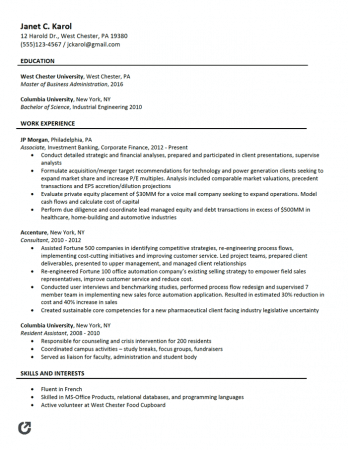

Since accounting jobs require immense attention to detail, the resume must adhere to the same standard. Make sure it is accurate and free from errors or inconsistencies. Regardless of the accountant’s career stage, the applicant must include their title, certification(s), or field-specific markers (i.e., CPA, GAAP, or QuickBooks). Providing this information increases the candidate’s credibility and raises the possibility of an interview. The placement of the title can make a difference, as well. For this reason, be sure to display it in large or bold font on the top of the page.

The accountant’s experience level influences the information presented in the resume. “Experience” refers to the number of years worked, along with positions held, internships completed, and the names of previous employers.

Regardless of the job’s tier or ranking, the prospective employee must include previous roles or experiences that highlight their competencies. They should specifically focus on large or unique projects that set them apart from other candidates. For example, an applicant would want to include that they “managed private foundation grants totaling over $35 million” or “developed controls to reduce errors by 18%.” Similarly, they would benefit from stating that they “processed 50+ vendor invoices per month with 100% accuracy” or “prepared 10 tax returns in the previous year.”

The profession considers entry-level accountants as individuals that have worked anywhere from zero (0) to two (2) years. Accountants new to the workforce have less experience than those who have been in the profession for a longer amount of time. For this reason, they must include relevant work experience, volunteer work, or additional details that demonstrate their knowledge and/or capabilities. Including applicable skills in a resume (e.g., math, auditing, banking, etc.) helps to give applicants more leverage over more experienced candidates. The goal of entry-level accountants is to find a job that allows them to gain experience and build their resumes to advance their careers. Entry-level accountant jobs include:

A mid-level accountant has more experience than an entry-level employee as they have been in the career between two (2) and eight (8) years. They gain the critical skills needed to move onto an expert accountant role during this time. They have more responsibility and may take on managerial positions. The following list contains examples of jobs for mid-level accountants:

An individual only takes on the expert accountant title if they have worked in the field for eight (8) years or more and have taken on a managerial position. Expert accountants are confident in their abilities and have a strong knowledge of the role. They may be responsible for overseeing a larger group of employees, such as a department. In addition, they may have to examine complicated financial documents and reports. Senior-level accountant jobs may have titles, such as: